![]()

Anthony Dobson

CEO | OnDemandIQ

The global dominance of Hollywood studios continues to define the streaming landscape, with US-originated content holding a significant edge in markets like Indonesia. Data from AudienceIQ underscores this trend, showing that American productions—especially first-run movies—command a substantial share of viewership on platforms like Netflix. For studios, this influence prompts a critical debate about content distribution strategies in the streaming era, balancing traditional syndication with digital platforms.

This analysis explores the role of US studio content in Indonesia’s streaming ecosystem, using AudienceIQ data from Indonesian Netflix users in March 2025. It centers on the strategic decisions of studios, notably Sony, which is increasingly pivotal in shaping the future of content syndication and digital distribution.

The Studios’ Perspective: Leveraging Content for Global Reach

For studios, the shift from traditional syndication to streaming reflects a transformative moment in the media industry. As Tim Hanlon (@timhanlon) notes in his article Is This The Beginning Of The End Of Broadcast TV Syndication?, studios are reclaiming control over their content as broadcast syndication declines. Sony exemplifies this trend, having pulled iconic shows like Jeopardy! and Wheel of Fortune from syndication to secure direct streaming deals with platforms like Amazon’s Prime Video. This strategic pivot underscores a broader goal: leveraging content libraries to maximize revenue and global reach through digital channels.

In Indonesia, this approach pays dividends. AudienceIQ data shows US productions accounting for 42% of cumulative audience impressions on Netflix, a testament to Hollywood’s enduring appeal. For Sony, with its strong portfolio of films and series, this dominance offers a prime opportunity to deepen its foothold in international markets via streaming partnerships.

Indonesia (March 2025): The Dominance of US Content on Netflix

A deeper look at content formats reveals the studios’ strategic priorities:

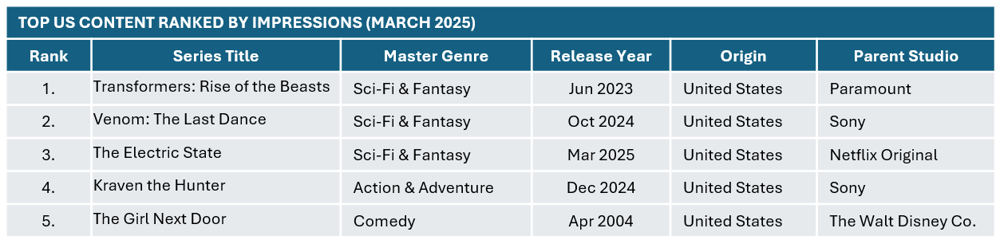

- Movies: US movies lead with 51% of viewer impressions, driven by high-profile first-run releases. Paramount’s Transformers: Rise of the Beastand Sony’s Venom: The Last Dance stand out, capitalizing on global marketing and cinematic spectacle to attract Indonesian viewers.

- Series: US series capture 21% of impressions but face stiff competition from South Korean series at 28%. This split highlights a challenge for studios to innovate in serialized content amidst growing regional competition.

Strategic Implications for Studios

The Indonesian Netflix data provides actionable insights for studios refining their global strategies:

- Adapting to Linear’s Decline: With traditional linear TV and syndication fading, studios like Sony are leaning on streaming to distribute content efficiently. This shift demands new approaches to release timing, pricing, and audience targeting to optimize returns on high-value assets.

- Balancing Global and Regional Dynamics: Hollywood’s universal appeal remains a strength, as seen with Sony’s Venom: The Last Dance. Yet, the rise of South Korean series suggests studios may need to explore co-productions or regional partnerships to stay competitive in serialized formats.

- Maximizing First-Run Movies: The success of first-run films in genres like Sci-Fi & Fantasy and Action & Adventure—exemplified by Kraven the Hunter—underscores their role in driving platform engagement. Studios can use these releases to negotiate lucrative licensing deals or prioritize direct-to-streaming models.

|

Majors Driving Consumption An analysis of viewing hours of Netflix US movies in Indonesia highlights the pivotal role of 4 of the 5 major Hollywood studios in driving engagement. Studio-produced content accounts for a significant share of total consumption, with Sony leading at 40%, followed by Warner (21%), NBCUniversal (14%), and Paramount (9%). This dominance underscores the importance of studio partnerships as a strategic component of content acquisition, particularly in markets where US content resonates strongly with local audiences. |

Conclusion: Studios Shaping the Streaming Future

Hollywood studios, with Sony at the forefront, are redefining the streaming landscape through strategic content distribution. By leveraging first-run movies studios maintain a commanding presence in markets like Indonesia. As they adapt to the decline of linear licencing opportunities and the rise of digital platforms, their decisions will continue to shape the global media ecosystem, balancing blockbuster appeal with evolving viewer preferences.

The Power of AudienceIQ: Unlocking Actionable Insights

Understanding the nuanced interplay between the enduring popularity of US content and the growing demand for regional content is crucial for developing effective content strategies in Southeast Asian markets like Indonesia. At OnDemandIQ, our AudienceIQ tool provides the granular data necessary to understand these details. By leveraging passive data across all devices, including CTVs, we empower platforms to make data-driven decisions that directly align with their audience's behavior. This allows for a more effective allocation of resources, enhanced viewer engagement, and ultimately, a stronger competitive position in the dynamic streaming landscape.

Request a demo of AudienceIQ today and discover how our insights can transform your platform’s performance. Book a time here.